The Sky’s the Limit: Understanding China’s UCAV Exports

April 1, 2025

Author: Adya Madhavan is a Junior Research Analyst with the High-Tech Geopolitics Programme at the Takshashila Institution, Bengaluru, India.

Contact: adya@takshashila.org.in

Acknowledgements: The author would like to thank her colleague Anushka Saxena for her contributions and feedback.

Disclosure: The author has utilised ChatGPT and NotebookLM for citations.

Executive Summary

China has emerged as one of the world’s leading developers of Unmanned Combat Aerial Vehicles (UCAVs). This is reflected in China’s exports of UCAVs, especially across West Asia and Central Africa. This document examines the factors that have enabled China to build such a robust export market, the politics of UCAV exports, and the implications for other countries, including India.

The key takeaways are as follows:

China exports UCAVs to approximately 18 countries, with key importers being Pakistan, Saudi Arabia, the United Arab Emirates (UAE), and Egypt. Of these customers, only Pakistan is a major importer of Chinese arms.

China’s exports often serve not only its economic interests but also for the CCP to expand its influence and serve its broader geopolitical interests. In many cases, these countries are part of the Belt and Road Initiative (BRI) or are critical to China’s regional ambitions.

China’s UCAV exports are enabled by a robust domestic ecosystem to develop and make these systems. The PLA has implemented many policies that prioritise excelling in high-tech production, autonomy and robotics—some of the integral aspects of UCAV production.

Introduction

Uninhabited aerial platforms offer some key advantages to militaries. Missions that would otherwise require highly trained pilots and expensive combat aircraft can be sometimes be carried out with UCAVs. These platforms can also perform some dangerous or dull tasks without putting humans into harm’s way. These features of UCAVs enable them to be used for various functions, from intelligence, surveillance and reconnaissance (ISR) to electromagnetic warfare. UCAVs can also be fitted with various attachments, such as Collision Avoidance Systems, that allow them to perform more sophisticated functions, such as automated detection and avoidance of obstacles.

Electromagnetic warfare (EW) is the use of the electromagnetic functions to gain a tactical advantage. It consists of three key components: electronic attack (jamming, deception); electronic protection (safeguarding communications); and electronic support (detecting and analysing signals for ISR and targeting).

Many of these functions alter the way aerial combat and surveillance take place. For instance, there is manned-unmanned teaming (MUM-T), where mission effectiveness is improved through collaborative efforts using UCAVs and piloted aircrafts, capitalising on UCAVs’ ability to safeguard human pilots in riskier contexts. Unmanned vehicles can increase situational awareness and firepower, supporting aircraft and helping conduct high-risk missions while limiting how many pilots are endangered. Swarming is another potential use of UCAVs that can change how battles are fought. Groups or ‘swarms’ of UCAVs on a single network can perform coordinated attacks.

The Russia-Ukraine war has seen UCAVs being used at an unprecedented scale. Both countries can now reportedly produce as many as four million UCAVs a year, ranging from smaller, remotely piloted and close-range vehicles – resembling the popularly used first-person-view (FPV) drones – to larger vehicles, more akin to aircraft in terms of size and wingspan, with the capacity to carry a significant weapons payload.

It raises two important questions: Why are UCAVs vital to contemporary warfighting, and why does China’s role matter?

For the purpose of this paper, a UCAV is defined as any aircraft that can operate without a human pilot on board and has the capacity to carry weapons payloads and deploy them. This document does not look at UAVs, which are unmanned but not weaponised. It also only considers fixed wing UCAVs, since a large proportion of Chinese UCAV exports fall into this category.

‘Why UCAVs?’ is a more straightforward question to address, and the answer lies in the features of UCAVs and their adaptability for different use cases. The question of China’s importance to the UCAV ecosystem speaks for itself through the sheer number of countries that import and utilise China’s UCAVs in their militaries, as well as the many examples of Chinese UCAVs being used in conflicts across the globe. An important aspect of Chinese UCAVs is that they are not known for being the best in the market– whether in terms of speed or weapons payloads. Despite this, Chinese UCAVs have dominated the export market, while US-made UCAVs, which are technologically superior, lag behind.

While the scope of this paper is limited to UCAVs and not civilian UAVs, the example of DJI is a helpful example to answer why Chinese UAV exports are essential to study. The Chinese company DJI (Da Jiang Innovations) has captured much of the global market for commercial, high-performance drones. While the company has opposed the military use of its products, Ukraine continues to repurpose DJI Mavic drones for combat. However, relying on DJI drones has raised concerns in Ukraine about vulnerabilities and data security. Concerns have been raised by foreign lawmakers about operational data being sent back to China, relaying sensitive information, and giving China insights on the performance of their drones.

China exports UCAVs to eighteen countries across the world, some of whom it has larger defence contracts with, and many of whom are members of the Belt and Road Initiative (BRI), which is a Chinese development strategy, and is central to PRC President Xi Jinping’s foreign policy.

Considering these aspects, this paper seeks to explore China’s UCAV ecosystem, its UCAV exports, the role those exports play in helping China achieve its strategic goals, and the role Chinese UCAVs play in the international sphere.

China’s UCAV Ecosystem: An Overview

China’s UCAV ecosystem is rapidly becoming more sophisticated. Chinese UCAVs are widely known for being cost-effective, and can also usually put in more flight time / have more endurance than other countries’ drones – even if they may not fly as fast, or may not carry payloads as large as their American alternatives.

Other major UCAV exporters: Israel, Turkey and the United States are the other largest exporters of UCAVs. There have been reports of Turkey’s Kargu-2 being used in Libya as early as 2020. This was the first report of UCAVs potentially being used to attack human targets.

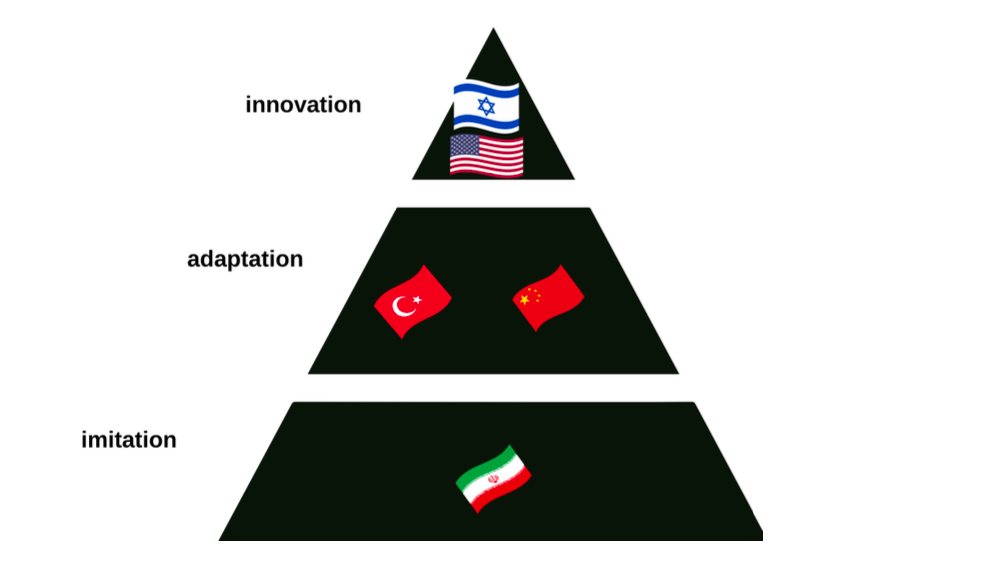

China’s UCAV ecosystem initially developed by adapting existing technologies, such as the technologies required for commercial drones, and by making similar products to popular, tried-and-tested foreign UCAVs (see Figure 1, below). Some Chinese UCAVs superficially resemble the most commonly used American UCAVs. However, they have surpassed their American counterparts in some characteristics. For instance, the Chinese Wing Loong 2 is visibly similar to the American MQ-1 predator, but the Wing Loong 2 and 3 are faster and can carry a greater payload than the General Atomics MQ-1 Predator.

It is worth looking at how China manufactures and develops UCAVs to understand the factors that enable it to export the way it does. There are two broad spheres worth looking at on this front: the major governmental and non-governmental players involved, and the policies that facilitate manufacturing and R&D. While these may not directly explain China’s exports, understanding what China does well helps understand what enables the scale of China’s exports. Additionally, while Turkey is the largest exporter in absolute terms, China appears to be leveraging its UCAV exports in order to fulfil its wider economic and strategic ambitions, as explored later in this paper.

Major Players

One of the aspects of China’s UCAV ecosystem that allows it to operate the way it does is the role played by its different stakeholders. Government-run bodies and research institutes collaborate with private tech companies, and the PLA helps by utilising UCAVs primarily in their UAV brigades. Not only do these UAV brigades help the armed forces with operational readiness, but they also help companies test out UCAVs in a military environment, enabling them to develop technologies that are specifically tailored to the requirements of the military.

There are many stakeholders in the Chinese UCAV ecosystem, including the PLA, government, and academic bodies and private industry. However, given the nature of the Chinese market, many industry players also tend to have some ties with the PLA or the CCP (even if, on paper, they are privately controlled).

The most important state-owned enterprises (SOEs) are China Aerospace Science and Technology Corporation (CASC), China Aerospace Science and Industry Corporation (CASIC), and the Aviation Industry Corporation of China (AVIC).

CASC is a state-owned enterprise that is in charge of R&D and production of aerospace products, including UCAVs. It also runs a subsidiary institute, The China Academy of Aerospace Aerodynamics (CAAA), that produces and exports some series of UCAVs. CASC is the biggest body in China’s space programme. CASIC is a state-owned enterprise that focuses on missile systems and aerospace technology, and contributes to UCAV R&D through many research institutions. Finally, AVIC is a state-owned enterprise that manufactures and designs military aircraft, including UCAVs. It has multiple subsidiary companies, such as the Chengdu Aircraft Industry Group (CAIG), which has developed UCAVs that have been widely exported.

Several other major government bodies also play a role. For instance, there is the Chinese Ministry of Commerce, which regulates the exports of military and dual-use technologies, including UCAVs. Most recently, in July 2024, the ministry adjusted export controls on UAVs to prohibit the export of civilian drones for military use cases. Then, there is the State Administration of Science, Technology and Industry for National Defense (SASTIND), which oversees the development of various military technologies and coordinates military needs and technological capabilities.

The People’s Liberation Army, the PRC’s unified military organisation, is one of the primary end-users for all Chinese-made military technologies, including UCAVs. It incorporates them in its training and exercises and thus invariably lets UCAV testing take place.

Finally, private enterprises work with these various arms of the government. It may be difficult to concretise and identify major private companies involved in UCAV manufacturing along with SOEs, but the emphasis on civil-military fusion means the private sector is very much involved. It is also important to note that most so-called private Chinese aerospace companies have ties with either the party-state or the military, if not both.

Enabling Government Policies

The Chinese government’s policies have helped catalyse the rapid growth of its UCAV ecosystem and exports. Over the last decade and a half, policies tailored towards the growth of military innovation and production have been rolled out. The following policies have played important roles in allowing China to emerge at the forefront of the global UCAV market.

Made in China 2025

The Made in China 2025 plan prioritises specific sectors in which R&D and manufacturing are to be ramped up. It has priority sectors which are designated areas of focus, including UCAVs. One of its central principles is emphasising innovation-driven manufacturing, which is critical in the UCAV sector. This also ties in with other strategies that focus on fostering innovation.

Military-Civil Fusion (MCF) Strategy

The MCF strategy is a national strategy of the Chinese government that aims to eliminate barriers between civilian technology research, key-component and tech manufacturers, and the PLA. By integrating these three arms, the CCP seeks to establish China as a “world-class fighting force” by 2049. This aligns with China’s broader strategic and geopolitical goals, establishing itself as a global military leader, and becoming a large exporter of advanced technologies. There is an emphasis on capitalising on so-called ‘dual-use’ technologies that have civilian applications but can be adapted for military use as well, not unlike drones.

The MCF differs from other military-industrial complexes because it features a top-down approach, where the integration of the military and the private sector is state-driven. Additionally, the MCF strategy also has legal backing: the National Intelligence Law (2017) legally obligates the private sector to cooperate for defence innovation and intelligence-sharing.

Next Generation Artificial Intelligence Development Plan (NGAIDP)

The NG-AIDP is a three-phase roadmap that outlines steps for China to become a global leader in AI by 2030. It highlights the important role AI will likely play in the coming years in economic and industrial transformation as well as national security. This includes the development of unmanned systems and surveillance and cybersecurity applications. The plan targets four core AI technologies, one of which is autonomous systems. The NG-AIDP is also aligned with the MCF strategy, in that it lays emphasis on the need for civilian AI advancements to strengthen military AI capabilities.

Science of Military Strategy

The Science of Military Strategy (2020) is an extensive doctrinal document. It rolls out directions for both the use and development of military forces. The Science of Military Strategy is updated periodically to keep up with evolving modes of warfare, and the most recent version incorporates emergent warfare trends. The primary objectives align with all of the previously discussed strategies and plans, emphasising the importance of safeguarding Chinese national security, civil-military fusion, integrated deterrence, and joint operations using evolving technologies to remain globally competitive. It promotes AI-enabled warfare, which aligns with China’s development of autonomous and semi-autonomous UCAVs. The emphasis on civil-military fusion has also encouraged public-private partnerships that have allowed private firms such as DJI to collaborate with government bodies.

By virtue of being an integrated ecosystem, lessons learnt from testing are funnelled back into the design and production spheres. The PLA also integrates UAVs with their training and exercises, allowing for insights about performance to be plugged back into R&D. Strategic initiatives such as ‘Made in China 2025’ incentivise domestic production and streamline the production process. This has led to an increase in the indigenous manufacturing of core components, resulting in Chinese products not being reliant on the imports of critical components. Additionally, this control over the UAV component supply chain gives China an additional advantage since not many countries are currently manufacturing these components and are forced to purchase from China.

All these different factors allow China to be able to produce UCAVs at a significant scale. These economies of scale translate into competitive pricing, with Chinese UCAVs being offered at a fraction of the cost of Western alternatives.

China’s UCAV Exports

The Largest Customers

China’s UCAV exports serve a dual purpose. While they enhance the military capability of their buyers, they also strengthen Beijing’s strategic foothold in the countries they are exported to. They also allow Chinese UCAVs to be tested effectively in battle, giving China operational insights as well.

According to the SIPRI Arms Transfer Database, China has exported UCAVs to seventeen countries worldwide– notably, some of the biggest buyers are Gulf Countries and Central African countries. While the exact order values are not available, the database provides an approximate idea of which countries are the biggest importers of Chinese UCAVs, and it gives a sense of the objectives China is trying to achieve through its exports.

This section will examine the four biggest importers of Chinese-made UCAVs, for whom there is relatively more publicly-available data. In the table below, China’s sphere of influence in both Central Africa and the Middle East can be seen.

Combat usage reports: Out of this pool of countries, there have been reports of a handful of countries having used Chinese UCAVs in combat. Saudi Arabia has used them in Yemen; Iraq has supposedly used them to carry out air raids; and Ethiopia has utilised China’s UCAVs against various groups opposing the government, such as the Tigray People’s Liberation Front. Interestingly, despite significant reporting on Ethiopia’s use of Chinese UCAVs, including the Wing Loong 2 and CH-4, there is no information available on the details of those transfers.

| Country | Approximate Quantity Ordered |

|---|---|

| Pakistan | 103 |

| Saudi Arabia | 85 |

| UAE | 50 |

| Egypt | 42 |

| Algeria | 29 |

| Laos | 20 |

| Iraq | 20 |

| Myanmar | 12 |

| Congo | 9 |

| Nigeria | 9 |

| Serbia | 7 |

| Indonesia | 6 |

| Jordan | 6 |

| Sudan | 5 |

| Uzbekistan | 5 |

| Turkmenistan | 4 |

| Kazakhstan | 3 |

| Ethiopia | ? |

China’s biggest importer today is Pakistan, according to SIPRI data. Additionally, there have been reports that both countries will co-produce Chinese-designed Wing-Loong II UCAVs. The earliest recorded order for armed UAVs was in 2011 (50), with two sizable subsequent orders. Beyond this, Pakistan also imports a significant number of dual-use UAVs. There have been reports of dual-use DJI-made drones being recovered on the Indian side of the Indo-Pak border, and India is prioritising anti-drone measures. While there haven’t been reports of larger combat-specific UAVs being used, the orders indicate that Pakistan is equipped with several models of UCAVs, and it appears to have already begun integrating unmanned vehicles within its armed forces.

This is not surprising given the proximity between Pakistan and China. Pakistan’s Ministry of Foreign Affairs refers to China as ‘one of its closest friends’. The countries regard each other as strategic allies, and have supported each other’s positions on controversial disputes, such as the Kashmir issue and the political status of Taiwan. Pakistan’s UCAV imports reflect Pakistan’s wider arms purchases from China. Pakistan is the 8th largest importer of arms globally, and China is its biggest supplier.

After Pakistan, Saudi Arabia is the biggest importer of Chinese UCAVs. The Gulf nation has also used Chinese combat UAVs in air strikes against the Yemeni Houthis, although the details of the exact models that were used are unavailable. In addition to being the recipient of large UCAV export orders, Saudi Arabia has also signed a joint venture with China Electronics Technology Group that will focus on the production of different UAV components within Saudi Arabia.

Saudi Arabia’s largest order from China was in 2017, an order of Wing Loong II drones that was claimed to be China’s largest-ever arms export at the time. Most recently, in 2024, Saudi Arabia placed an order for the Wing Loong 10B– an export variant of the Wing Loong 10, which is yet to be delivered. The 10B is a high-altitude long endurance (HALE) vehicle that was produced by the Chengdu Aircraft Industry Group for ISR and long-range precision strikes.

China’s growing proximity with Saudi Arabia and the UAE can be attributed to the changing dynamics in the energy markets and trade and the nature of US-China competition. According to Chinese diplomats, China brokered a resumption of bilateral relations between Iran and Saudi Arabia in 2023, a sign of China’s presence and role in the Gulf.

Interestingly, while Saudi Arabia is one of the biggest importers of Chinese UCAVs, it is not one of the largest recipients of arms in general from Chinese manufacturers. Saudi Arabia’s arms deals with China have exponentially grown in the last few years, but imports are primarily restricted to UCAVs and missiles.

The UAE is also one of the biggest importers of China’s UCAVs. The country’s tryst with UAVs began in 2013, when the UAE purchased American UAVs (MQ-1 Predator XPs from General Atomics). The export versions of the Predator that the United States sold to the UAE were modified to be unable to carry weapons payloads. In response, the UAE looked elsewhere for armed UAVs and purchased Wing Loongs from China– widely touted as the Chinese equivalent to the Predator. Soon after, China supplied the UAE with Wing Loong II, the next generation of Wing Loong that, most importantly, can carry a greater weapons payload than its predecessor.

The UAE and China have a relationship similar to that of China and Saudi Arabia, which is characterised by trade and strategic partnerships. Not unlike Saudi Arabia, the UAE is also a relatively small importer of Chinese arms overall. The countries have signed agreements for joint production, and Chinese defence products are the focus of much attention in the UAE. Yet, the actual sales to the UAE are low, restricted to missiles and unmanned vehicles. This is potentially due to the presence of Western arms suppliers in the Gulf, who continue to win most procurement contracts, despite cooperation with China for R&D.

Finally, Egypt is the fourth largest importer of Chinese UCAVs. Economically, the unique location of Egypt – bridging Africa and the Middle East – makes it an important economic region for China, since much of its trade to Africa passes through Egypt. The relationship is characterised by economic significance.

Egypt has imported approximately 42 UCAVs from China, and there have been reports of Wing Loong II drones being used against groups in Sinai. Although, again, the numbers may not be exact, Egypt’s use of Chinese UCAVs is publicly known. Egypt was the seventh largest importer of arms between 2019-2023 in the world, with its imports largely restricted to missiles, aircraft and surveillance systems. It was one of the larger importers of Chinese arms up until 2010, but its reliance on China seems to have decreased since then. Egypt’s biggest arms supplier is the United States, but in 2024, Egypt chose to replace its fleet of F-16s with Chinese fighters instead of purchasing an American alternative, indicating a willingness to purchase critical military infrastructure from China despite the availability of Western options.

Models Exported

While all the UCAVs China exports perform more or less the same range of functions (ISR, precision strikes, etc.), their specific capabilities differ. Looking at the most commonly-exported models and their abilities, and comparing them to alternatives produced by other countries, gives a sense of the strategic reasons why countries purchase them.

Figure 5 (below) shows the number of different UCAVs exported up until 2024, according to the SIPRI arms transfer database. Although some countries have been in talks regarding procuring other models, such as the Wing Loong 10B, there is no exact data yet, so those potential transfers have been left out of this report.

The subsequent subsections focus on the Rainbow (CH) Series and the Wing-Loong Series, the two Chinese combat drone series that have most of the market share. Comparing these models with similar alternatives helps one understand why they are widely purchased and deployed.

Most aircraft in the Wing Loong series are powered by propellers and turboprop engines. The Rainbow series is typically smaller and powered by piston engines and a pusher-propeller configuration.

Navigation and communication: Regarding navigation and communication systems, the Wing Loong uses satellite communication to connect with the ground station. The Rainbow series uses multiple systems: for instance, the CH-3 has a satellite data link, while the CH-95 uses a SAR/GMTI radar. While there have been concerns that China may acquire operational data through the satellite communication network, there has been no evidence of the same. However, it is worth noting that countries purchasing UCAVs from China consider China a strategic ally or, at the very least, a trusted partner, although they are likely to have taken measures to ensure the system is secure.

The Wing Loong Series

The Wing Loong 1 and 2 of the Wing Loong series capture most of China’s UCAV export market share. The series is produced by the Chengdu Aircraft Industry Group, and is designed for ISR and precision strikes. It has many variants, of which Wing Loong 1 and 2 are the most prominent models. Wing Loong 1 is a Medium Altitude Long Endurance (MALE) UCAV that was first tested in 2007.

In terms of capabilities, the Wing Loong 1 and 2 are considered comparable to the American MQ-9 Reaper, and the Turkish Bayraktar TB2. While the Reaper has a higher service ceiling and weapons payload capacity than the Wing Loong 2, it has slightly lower endurance. The Bayraktar TB2, on the other hand, has a lower weapons payload capacity, but has comparable endurance to the Wing Loong 1 and 2.

Wing Loong 1 specifications at a glance: - Length: 9.05 meters - Wingspan: 14 meters - Maximum Takeoff Weight: 1,100 kg - Payload Capacity: 200 kg - Maximum Speed: 280 km/h - Operational Endurance: Up to 20 hours - Service Ceiling: 9,000 meters

Wing Loong 2 (upgraded version of Wing Loong 1) specifications at a glance: - Length: 11 meters - Wingspan: 20.5 meters - Maximum Takeoff Weight: 4,200 kg - Payload Capacity: 480 kg - Maximum Speed: 370 km/h - Operational Endurance: Up to 32 hours - Service Ceiling: 15,240 meters

The Rainbow Series

The Rainbow series is developed by CASC and includes a range of UCAVs that have been designed for various military applications. The CH-3, CH-4B, CH-92 and CH-95 all belong to the Rainbow series.

The CH-3 is a medium altitude, long endurance UCAV; it is designed for ISR and strike missions.

CH-3 specifications at a glance: - Length: Approximately 5.5 meters - Wingspan: Approximately 8 meters - Maximum Takeoff Weight: 640 kg - Payload Capacity: 80 kg - Maximum Speed: 220 km/h - Operational Endurance: Up to 12 hours - Service Ceiling: 5,000 meters - Armament: Capable of carrying two AR-1 air-to-surface missiles

The CH-4B is an upgraded version of the CH-4, and is a MALE UCAV designed for ISR and strike missions.

CH-4B specifications at a glance: - Length: 8.5 meters - Wingspan: 18 meters - Maximum Takeoff Weight: 1,330 kg - Payload Capacity: 345 kg - Maximum Speed: 235 km/h - Operational Endurance: Up to 40 hours - Service Ceiling: 7,000 meters - Armaments: It can carry various munitions, including AR-1 missiles and FT series bombs

The CH-92 is a short-range UCAV designed for reconnaissance.

Other models: There are reports of other models being exported as well, most recently multiple countries are said to have imported the Wing Loong 10, but confirmations of these deals are not available, and exact figures are not available either.

CH-92 specifications at a glance: - Length: 10 meters - Wingspan: 20 meters - Maximum Takeoff Weight: 3,300 kg - Payload Capacity: 800 kg - Maximum Speed: 300 km/h - Operational Endurance: Up to 30 hours - Service Ceiling: 9,000 meters

The CH-95 is a MALE UCAV that is designed to excel at strike and reconnaissance functions.

CH-95 specifications at a glance: - Length: 10 meters - Wingspan: 20 meters - Maximum Takeoff Weight: 3,300 kg - Payload Capacity: 800 kg - Maximum Speed: 300 km/h - Operational Endurance: Up to 30 hours - Service Ceiling: 9,000 meters

In terms of how the Rainbow series compares with other countries’ UCAVs, the various models are more or less comparable with Israeli and American UCAVs. For instance, the CH-4B is seen as comparative to the MQ-1 Predator; the predator has a lower payload capacity, but the two models are more or less equal in terms of speed and service ceiling. Similarly, the CH-95 is seen as similar to the Israeli Heron TP. The CH-95 has longer endurance, but the Heron surpasses it in terms of payload capacity, speed and service ceiling.

While the exact costs of UCAVs are hard to discern – they are typically sold in packages or as parts of larger arms deals – even aside from the widely-acknowledged lower costs, Chinese UCAVs are also reasonably competitive in terms of performance.

A Framework for Understanding Chinese UCAV Exports

China’s exports are not merely for economic reasons; arms deals are also typically a part of larger interests that China tends to have in a country. Larger trade interests, deeper alliances, and China’s ambitions in the region determine China’s interests in a country, which tends to be reflected in the size of arms export orders and joint ventures to produce UCAVs within those countries. In some cases, the stakes are lower for China, but the operational needs of buyers serve as the driving factor that determines the nature of arms deals, including UCAV exports.

Chinese UCAV exports context: Chinese UCAV exports are part of its wider arms exports– China was the fifth largest exporter in the world between 2019-2023 and the largest exporter of UCAVs.

A few factors impact why countries may resort to buying from China if their military requirements call for importing UCAVs.

Firstly, the United States – the leading player in terms of UCAV manufacturing – is much more stringent with its exports. While China has exported over 200 UCAVs to 18 countries, the US has exported only 12 UCAVs, and even when it exports models typically capable of carrying weapons, some of these are modified to be unarmed.

Secondly, China’s UCAVs are comparatively more affordable. When adopting unmanned vehicles that are typically reliant on expensive legacy models, it makes sense for countries to want alternatives that are more affordable, to be able to purchase multiple UCAVs and upgrade their armed forces. While all the figures are not readily available, the numbers speak for themselves: the US-made Reaper and Predator cost $16 million and $4 million, respectively, China’s CH4 and Wing Loong 2 are estimated to cost between $1-2 million. This allows for larger orders, and while Chinese aircraft may not perform as well on some fronts, many countries may not be looking for the top-most of the line, and are likely to be more than willing to work with something that is good enough and a fraction of the cost. Moreover, China’s payment terms are reportedly flexible, and China is known to allow countries to pay in instalments and even pay for UCAVs in exchange for commodities like minerals.

For China, one of the biggest drivers of arms exports is using arms sales as a diplomatic tool with countries that are members of the Belt and Road Initiative (BRI). The BRI is an infrastructure and economic connectivity project that spans from China across Asia, Africa the Middle East, and even to Europe. It aims to connect China with Asia, Africa and Europe through road and maritime networks.

As seen in Figure 3 below, the countries that China exports UCAVs to are along this route, and most of them have joined the BRI. China continues to reiterate the peaceful nature of the BRI, but many have commented that it is an enabler for China to achieve its wider geopolitical goals. Many member countries of the BRI face insurgencies and conflicts, creating a demand for advanced drones with ISR and combat capabilities at affordable rates.

Especially in the Middle East and Africa, arms sales also allow China to consolidate its influence where there is a void left by Western arms export restrictions providing an opportunity for Chinese firms to seize. It is worth noting that fourteen of the eighteen countries importing Chinese UCAVs are members of the BRI, including Saudi Arabia, UAE, Egypt and Pakistan.

The following matrix takes these drivers of Chinese exports into account, and looks at the outcomes of varying degrees of strategic investment on China’s part, along with the varying extent to which importing countries require Chinese UCAVs.

Low Strategic Alignment / High Operational Needs

This quadrant explains situations where countries have immediate combat or security needs and purchase Chinese UCAVs as an affordable solution, often due to financial constraints as well. Although China may lack strategic stakes in these countries, it benefits from the revenue of arms exports. In these situations, there are typically UCAV export orders, but China tends to expend a lower effort to deepen its long-term influence through training, joint production ventures, or servicing.

Nigeria is an example of this: it requires UCAVs, potentially for counterinsurgency measures against Boko Haram, but isn’t a key strategic ally of China (though it has been a part of the BRI since 2018).

Low Strategic Alignment / Low Operational Needs

This quadrant explains arms sales to countries that have limited battlefield needs for UCAVs – typically countries with no ongoing conflicts and no adversarial relations with neighbouring countries. These countries may purchase UCAVs as a technological investment, surveillance, or as a political sign of alignment with China. The very limited requirement tends to be reflected in the relatively small number of UCAVs imported. As a result, China gains a market presence in such countries. but does not actively attempt to increase its market presence or create any dependency.

Kazakhstan is an example of such a situation. It is not actively engaged in any conflicts that would necessitate a high demand for UCAVs, and instead, its military requirements are directed towards more general modernisation. China also does not have any deeper defence agreements with Kazakhstan – unlike China’s ties with countries like Pakistan and Saudi Arabia – and beyond some limited economic interests, China has relatively low stakes. Kazakhstan has also purchased only 3 UCAVs from China, the lowest number of all known purchasers, indicating that there is no urgency or military requirement that would call for larger numbers.

High Strategic Alignment / Low Operational Needs

This quadrant explains circumstances where countries don’t necessarily have an urgent need for UCAVs to be a part of their military arsenal, but it is in China’s interest to have good relations with the country, and Chinese strategic investment is high. UCAV sales can function as a tool for strengthening diplomatic and economic ties, even if the buyer doesn’t see them as an urgent purchase. In these cases, China embeds itself in the country’s defence procurement, establishing long-term investment for future scenarios when the country may have more pressing requirements.

Indonesia is one of the most interesting examples of such a country because it has no active conflicts or territorial skirmishes, unlike Saudi Arabia or Pakistan, and has no urgent requirement for armed drones. While there are some security concerns regarding maritime disputes in the South China Sea, UCAVs are not the primary tool for addressing them. Additionally, the Indonesian Air Force is not known for its heavy reliance on combat drones, so acquiring UCAVs is more important for modernisation.

However, China has major investments in Indonesia– it is one of the largest BRI recipients in Southeast Asia, which is reflected in projects such as the Jakarta-Bandung High-Speed Railway. China is also one of Indonesia’s largest trade partners, and China has a significant presence in Indonesia’s key economic zones. Given the number of UCAVs Indonesia has purchased from China (6 Wing Loongs), it seems as if these are efforts towards military modernisation, further driven by the close proximity between the two countries, rather than any pressing strategic need on Indonesia’s part.

High Strategic Alignment / High Operational Needs

This quadrant explains circumstances where countries have high operational needs for UCAVs, and China has high stakes and is willing to go beyond merely arms sales and deepen their ties. These countries typically have joint ventures for UCAV production with China, indicating China’s willingness to use these exports to deepen the relationship and make it mutually beneficial.

Saudi Arabia and the UAE are examples of such a situation; both countries have used Chinese UCAVs in Yemen, and need Chinese UCAVs due to the United States’ restrictions on armed drone exports. They also have deep economic ties (China is the biggest importer of hydrocarbons from the Gulf) and are critical members of the BRI. China also has many large contracts with these countries in other areas, reflecting the larger relationship, such as China Energy Engineering’s contract in Saudi Arabia worth $972 million for the construction of a solar power plant.

The Pakistan Case

China’s relationship with Pakistan is an example of leveraging arms exports to meet strategic goals. Arms exports (including UCAV exports), are only a small part of China’s engagement, and are more the means to an end.

India’s arms imports: When it comes to arms, India is mainly reliant on the US, Russia. and France. India’s proximity with the United States beyond mere arms sales strengthens China and Pakistan’s alignment, both of whom feel the need to counter India’s influence, especially as China’s global ambitions include wanting to counter US influence. Pakistan has emerged as the largest importer of Chinese arms over the last three decades.

China and Pakistan’s alignment is tied to both countries’ concerns about India. China sees India’s regional influence as a potential threat to its own strategic ambitions and finds a natural ally in Pakistan, which has historical issues with India. Pakistan also occupies a critical location between the Indian subcontinent, Central Asia, and the Middle East, which makes it important for the BRI to rely on connectivity and access. Both countries also have territorial disputes with India that makes their alignment logical. Pakistan and India’s historical dispute over Kashmir and China’s support for Pakistan’s stance makes Pakistan a supporter of Chinese positions on both disputed territories in Arunachal, as well as on China’s claim to Tibet.

Chinese infrastructural projects in Pakistan as well as the China-Pakistan Economic Corridor (CPEC) – a large part of China’s BRI – continue to deepen China’s penetration into Pakistan’s economy. Additionally, a large chunk of a $7 billion IMF bailout package that was given to Pakistan due to the state of its economy is owed to China.

Due to CPEC projects and financial aid, Pakistan now owes China a huge amount in external bilateral debt, which enables China to exert certain pressures on Pakistan. For instance, the two countries now have joint security initiatives, and China is pressing Pakistan to establish mechanisms to safeguard Chinese workers who are employed in Pakistan on various CPEC projects. There has also been a proposed mechanism which involves both Chinese personnel and Pakistani forces working together to patrol the border between Pakistan and Xinjiang, which is critical to the BRI and currently faces security concerns. Pakistan has approved large increments in funding to its army towards border security, particularly towards protecting Chinese interests. It has also institutionalised supplementary defence grants for counter-terrorism operations.

Pakistan’s defence budget has steadily increased given its security concerns and rivalry with India, which in turn benefits China’s economy and increases Pakistani dependence on China. Between 2019 and 2023, a whopping 82% of Pakistan’s military imports were from China. For instance, Pakistan bought a fleet of J-35 fighter jets in 2024 and procured two type 054A/P frigates in 2022.

In 2018, China and Pakistan announced via a social media post by the Pakistan Air Force that they will be jointly producing 48 Wing Loong II between China’s AVIC and Pakistan Aeronautical Complex (PAC). The deal has not been publicly acknowledged since then, and there have been no details as to whether the order has been completed. However, it is important to note since it is indicative of the security cooperation between Pakistan and China, the extent of China’s penetration in Pakistan as well as the level of dependence Pakistan’s military has on Chinese imports.

Conclusion

China has used UCAV exports to increase its relationships, both with traditional arms markets like Pakistan, as well as with states like Saudi Arabia and the UAE which do not rely extensively on Chinese arms.

These UCAV exports fill a significant market niche among customers that are either grappling with technology denial regimes or seeking uninhabited aerial systems at appropriate price points.

Similar market opportunities exist among India’s partners in the Indo-Pacific region. Tapping into these markets would serve multiple Indian interests, including the development of its own UCAV ecosystem, strengthening the defence capabilities of partner countries, and extending Indian influence.

As with China, any future Indian UCAV exports may gain the most from closely-aligned partners that have high operational needs. However, building these close defence ties will require India’s nascent UCAV ecosystem to develop rapidly.

References

www.sciencedirect.com. “Collision Avoidance System - an Overview | ScienceDirect Topics,” n.d..

Globaldata.com. “China Aerospace Science and Technology Corp Company Profile - Overview,” 2021..

Devex.com. “China Aerospace Science and Industry Corporation (CASIC) | Devex,” 2025. https://www.devex.com/organizations/china-aerospace-science-and-industrycorporation-casic-40775.

China Aerospace Studies Institute. “Organization of the Aviation Industry Corporation of China (AVIC).” Air University (AU), January 22, 2024. https://www.airuniversity.af.edu/CASI/Display/Article/3643494/organization-ofthe-aviation-industry-corporation-of-china-avic/.

Www.gov.cn. “State Administration for Science, Technology and Industry for National Defense,” 2025. http://english.www.gov.cn/state_council/2014/10/06/content_281474992893468.htm.

Kania, Elsa. “The PLA’s Unmanned Aerial Systems.” The United States of America: China Aerospace Studies Institute, n.d.

University, Stanford, Stanford, and California 94305. “Reassessing the Role of State Ownership in China’s Economy.” sccei.fsi.stanford.edu, January 15, 2024. https://sccei.fsi.stanford.edu/china-briefs/reassessing-role-state-ownership-chinaseconomy.

Kennedy, Scott. “Made in China 2025.” Center for Strategic and International Studies, June 1, 2015. https://www.csis.org/analysis/made-china-2025.

US Department of State. “The Chinese Communist Party’s Military-Civil Fusion Policy.” United States Department of State, 2021. https://2017-2021.state.gov/militarycivil-fusion/.

Daum, Jeremy. “What China’s National Intelligence Law Says, and Why It Doesn’t Matter.” China Law Translate, February 22, 2024. https://www.chinalawtranslate.com/en/what-the-national-intelligence-law-says-andwhy-it-doesnt-matter/.

Webster, Graham, Rogier Creemers, Elsa Kania, and Paul Triolo. “Full Translation: China’s ‘New Generation Artificial Intelligence Development Plan’ (2017).” DigiChina, August 1, 2017. https://digichina.stanford.edu/work/full-translation-chinas-newgeneration-artificial-intelligence-development-plan-2017/.

Air University (AU). “In Their Own Words: 2020 Science of Military Strategy,” January 26, 2020. https://www.airuniversity.af.edu/CASI/Display/Article/2913216/intheir-own-words-2020-science-of-military-strategy/.

Aosheng Pusztaszeri. “Why China’s UAV Supply Chain Restrictions Weaken Ukraine’s Negotiating Power.” Csis.org, 2024. https://www.csis.org/analysis/whychinas-uav-supply-chain-restrictions-weaken-ukraines-negotiating-power.

“Chinese Arms Sales in Sub-Saharan Africa.” Strategic Comments 30, no. 10 (December 13, 2024). https://doi.org/10.1080/13567888.2024.2442886.

Philip, Snehesh Alex. “China Has Become a Major Exporter of Armed Drones, Pakistan Is among Its 11 Customers.” ThePrint. theprint, November 23, 2020. https://theprint.in/defence/china-has-become-a-major-exporter-of-armed-dronespakistan-is-among-its-11-customers/549841/.

SIPRI. “SIPRI Arms Transfers Database | SIPRI.” Sipri.org, 2019. https://www.sipri.org/databases/armstransfers.

Gady, Franz-Stefan. “China, Pakistan to Co-Produce 48 Strike-Capable Wing Loong II Drones.” Thediplomat.com. The Diplomat, October 9, 2018. https://thediplomat.com/2018/10/china-pakistan-to-co-produce-48-strike-capablewing-loong-ii-drones/.

Sandhu, Kamaljit Kaur. “Security Forces Intercept 8 Drones in 2 Days in Punjab as Pak Exploits Smog Cover.” India Today, November 19, 2024. https://www.indiatoday.in/india/story/smog-in-punjab-border-security-forceintercept-drones-pakistan-exploits-fog-situation-2636156-2024-11-19.

mofa.gov.pk. “China,” n.d. https://mofa.gov.pk/china.

Rasheed, Zaheena. “How China Became the World’s Leading Exporter of Combat Drones.” www.aljazeera.com, January 24, 2023. https://www.aljazeera.com/news/2023/1/24/how-china-became-the-worlds-leadingexporter-of-combat-drones.

Helou, Agnes. “Chinese and Saudi Firms Create Joint Venture to Make Military Drones in the Kingdom.” Defense News, March 9, 2022. https://www.defensenews.com/unmanned/2022/03/09/chinese-and-saudi-firmscreate-joint-venture-to-make-military-drones-in-the-kingdom/.

Defaiya.com. “Al Defaiya | Saudi Air Force Acquires Chinese Wing Loong-10B Reconnaissance-Strike Drones,” February 14, 2024. https://www.defaiya.com/news/Defense%20News/Asia/2024/02/14/saudi-air-forceacquires-chinese-wing-loong-10b-reconnaissance-strike-drones.

Al Jazeera. “China-Brokered Saudi-Iran Deal Driving ‘Wave of Reconciliation’, Says Wang.” www.aljazeera.com, August 21, 2023. https://www.aljazeera.com/news/2023/8/21/china-brokered-saudi-iran-deal-drivingwave-of-reconciliation-says-wang.

Jash, Amrita. “Saudi-Iran Deal: A Test Case of China’s Role as an International Mediator.” Georgetown Journal of International Affairs, June 23, 2023. https://gjia.georgetown.edu/2023/06/23/saudi-iran-deal-a-test-case-of-chinas-roleas-an-international-mediator/.

Anas Al Qaed. “The Saudi-Sino Military Partnership: Ambitious or Overhyped?” Gulf International Forum, July 9, 2024. https://gulfif.org/the-saudi-sino-militarypartnership-ambitious-or-overhyped/.

Drew, James. “DUBAI: UAE’s Predator XP Procurement Paves Way for Future Sales.” Flight Global, November 10, 2015. https://www.flightglobal.com/dubai-uaespredator-xp-procurement-paves-way-for-future-sales/118849.article.

Ardemagni, Eleonora. “In GCC-Asia Rising Ties, Defence Industry Is the Key | ISPI.” ISPI, June 18, 2024. https://www.ispionline.it/en/publication/in-gcc-asiarising-ties-defence-industry-is-the-key-177951.

Stockholm International Peace Research Institute. “European Arms Imports Nearly Double, US and French Exports Rise, and Russian Exports Fall Sharply | SIPRI.” www.sipri.org, March 11, 2024. https://www.sipri.org/media/pressrelease/2024/european-arms-imports-nearly-double-us-and-french-exports-rise-andrussian-exports-fall-sharply.

Bitzinger, Richard. “IP23060 | China’s ‘One-And-Done’ Arms Buyers.” @RSIS_NTU, 2017. https://rsis.edu.sg/rsis-publication/idss/ip23060-chinas-one-anddone-arms-buyers/.

Turbosquid.com. “TurboSquid,” 2024. https://www.turbosquid.com/3dmodels/chinese-wing-loong-ii-3d-1439419.

China Defence Website. “AVIC Wing Loong I Drone (Medium-Altitude LongEndurance UAV),” 2021. https://www.militarydrones.org.cn/wing-loong-uav-dronechina-price-manufacturer-p00092p1.html.

China Military Drone Alliance. “CAIG Wing Loong 2 UAV Chinese Military Drones,” n.d. https://www.militarydrones.org.cn/wing-loong-2-uav-drone-chinaprice-manufacturer-p00093p1.html.

Turbosquid.com. “TurboSquid,” 2024. https://www.turbosquid.com/3d-models/ch4-uav-1456658.

China Defence Website. “Rainbow CH-3 Medium Range UAV,” 2025. https://www.militarydrones.org.cn/ch-3-rainbow-uav-drone-china-pricemanufacturer-p00096p1.html.

China Defence Website. “Rainbow CH-4 UAV,” 2021. https://www.militarydrones.org.cn/ch-4-rainbow-uav-drone-china-pricemanufacturer-p00095p1.html.

China Defence Website. “Rainbow CH-92 Medium Range Reconnaissance and Surveillance Multipurpose Tactical UAV,” 2025. https://www.militarydrones.org.cn/rainbow-ch-92-drone-china-price-manufacturerprocurement-portal-p00161p1.html.

China Defence Website. “Rainbow CH-95 Medium and Long Range Reconnaissance Strike UAV,” 2025. https://www.militarydrones.org.cn/ch-95-medium-and-longrange-reconnaissance-strike-uav-p00186p1.html.

Matthews, Ron, and Jonata Anicetti. “The Role of Defence Countertrade in Chinese Geoeconomic Diplomacy.” Journal of Strategic Studies, April 1, 2024, 1–31. https://doi.org/10.1080/01402390.2024.2327842.

ALDEN, CHRIS, LUKAS FIALA, ERIC KROL, and ROBERT WHITTLE. “Exporting Chinese UCAVs and Security?” LSE IDEAS, 2020. JSTOR. https://doi.org/10.2307/resrep45326.

Rasheed, Zaheena. “How China Became the World’s Leading Exporter of Combat Drones.” www.aljazeera.com, January 24, 2023. https://www.aljazeera.com/news/2023/1/24/how-china-became-the-worlds-leadingexporter-of-combat-drones.

Chan, Minnie. “South China Morning Post.” South China Morning Post, January 28, 2022. https://www.scmp.com/news/china/military/article/3165183/chinese-dronesdemand-algeria-and-egypt-eye-orders-worlds.

McBride, James, Noah Berman, and Andrew Chatzky. “China’s Massive Belt and Road Initiative.” Council on Foreign Relations, February 2, 2023. https://www.cfr.org/backgrounder/chinas-massive-belt-and-road-initiative.

Searcey, Dionne. “Boko Haram Is Back. With Better Drones.” The New York Times, September 13, 2019. https://www.nytimes.com/2019/09/13/world/africa/nigeria-boko-haram.html.

Kemelova, Fatima. “China Hails Strong Ties with Kazakhstan, Promises New Heights in 2024 - the Astana Times.” The Astana Times, January 9, 2025. https://astanatimes.com/2025/01/china-hails-strong-ties-with-kazakhstan-promisesnew-heights-in-2024/.

Kennedy, Scott. “Made in China 2025.” Center for Strategic and International Studies, June 1, 2015. https://www.csis.org/analysis/made-china-2025.

US Department of State. “The Chinese Communist Party’s Military-Civil Fusion Policy.” United States Department of State, 2021. https://2017-2021.state.gov/militarycivil-fusion/.

Daum, Jeremy. “What China’s National Intelligence Law Says, and Why It Doesn’t Matter.” China Law Translate, February 22, 2024. https://www.chinalawtranslate.com/en/what-the-national-intelligence-law-says-andwhy-it-doesnt-matter/.

Webster, Graham, Rogier Creemers, Elsa Kania, and Paul Triolo. “Full Translation: China’s ‘New Generation Artificial Intelligence Development Plan’ (2017).” DigiChina, August 1, 2017. https://digichina.stanford.edu/work/full-translation-chinas-newgeneration-artificial-intelligence-development-plan-2017/.

Air University (AU). “In Their Own Words: 2020 Science of Military Strategy,” January 26, 2020. https://www.airuniversity.af.edu/CASI/Display/Article/2913216/intheir-own-words-2020-science-of-military-strategy/.

Aosheng Pusztaszeri. “Why China’s UAV Supply Chain Restrictions Weaken Ukraine’s Negotiating Power.” Csis.org, 2024. https://www.csis.org/analysis/whychinas-uav-supply-chain-restrictions-weaken-ukraines-negotiating-power.

“Chinese Arms Sales in Sub-Saharan Africa.” Strategic Comments 30, no. 10 (December 13, 2024). https://doi.org/10.1080/13567888.2024.2442886.

Philip, Snehesh Alex. “China Has Become a Major Exporter of Armed Drones, Pakistan Is among Its 11 Customers.” ThePrint. theprint, November 23, 2020. https://theprint.in/defence/china-has-become-a-major-exporter-of-armed-dronespakistan-is-among-its-11-customers/549841/.

SIPRI. “SIPRI Arms Transfers Database | SIPRI.” Sipri.org, 2019. https://www.sipri.org/databases/armstransfers.

Gady, Franz-Stefan. “China, Pakistan to Co-Produce 48 Strike-Capable Wing Loong II Drones.” Thediplomat.com. The Diplomat, October 9, 2018. https://thediplomat.com/2018/10/china-pakistan-to-co-produce-48-strike-capablewing-loong-ii-drones/.

Sandhu, Kamaljit Kaur. “Security Forces Intercept 8 Drones in 2 Days in Punjab as Pak Exploits Smog Cover.” India Today, November 19, 2024. https://www.indiatoday.in/india/story/smog-in-punjab-border-security-forceintercept-drones-pakistan-exploits-fog-situation-2636156-2024-11-19.

“How Has China’s Belt and Road Initiative Impacted Southeast Asian Countries?” carnegieendowment.org, December 5, 2023. https://carnegieendowment.org/posts/2023/12/how-has-chinas-belt-and-roadinitiative-impacted-southeast-asian-countries?lang=en.

Jowett, Patrick. “China’s CEEC Wins 2 GW Solar Project in Saudi Arabia.” pv magazine International, August 14, 2024. https://www.pvmagazine.com/2024/08/14/chinas-ceec-wins-2-gw-solar-project-in-saudi-arabia/.

cpec.gov.pk. “CPEC | China-Pakistan Economic Corridor (CPEC) Authority Official Website,” n.d. https://cpec.gov.pk/.

Reuters Staff. “Pakistan PM Sharif Welcomes IMF’s $7 Billion Funding Agreement.” Reuters, September 25, 2024. https://www.reuters.com/world/asia-pacific/pakistanwins-approval-imf-board-7-bln-bailout-bloomberg-reports-2024-09-25/.

PTI. “China Still Pakistan’s Top Bilateral Creditor, Share down to 22% from 25% Last Year: WB.” The Times of India. Times Of India, December 5, 2024. https://timesofindia.indiatimes.com/business/international-business/china-stillpakistans-top-bilateral-creditor-share-down-to-22-from-25-last-yearwb/articleshow/115989075.cms.

Shahzad, Asif. “Exclusive: Beijing Pushes to Join Security Efforts for Citizens in Pakistan, Sources Say.” Reuters, November 12, 2024. https://www.reuters.com/world/asia-pacific/beijing-pushes-join-security-effortscitizens-pakistan-sources-say-2024-11-12/.

Le, Vanessa. “Pakistan’s Security Challenges Threaten to Undermine Its Relationship with China • Stimson Center.” Stimson Center, November 20, 2024. https://www.stimson.org/2024/pakistans-security-challenges-threaten-to-undermineits-relationship-with-china/.

“European Arms Imports Nearly Double, US and French Exports Rise, and Russian Exports Fall Sharply | SIPRI.” www.sipri.org, March 11, 2024. https://www.sipri.org/media/press-release/2024/european-arms-imports-nearlydouble-us-and-french-exports-rise-and-russian-exports-fall-sharply.

Kumar, Bhaswar. “Pakistan May Fly Chinese Stealth Jets in 2 Years: Could It Outpace IAF?” @bsindia. Business Standard, December 24, 2024. https://www.business-standard.com/external-affairs-defence-security/news/pakistanmay-fly-chinese-stealth-jets-in-2-years-could-it-outpace-iaf-124122400442_1.html.

Ozberk, Tayfun. “Chinese Shipyard Delivers Final Two Type 054 A/P Frigates to Pakistan Navy.” Naval News, May 11, 2023. https://www.navalnews.com/navalnews/2023/05/chinese-shipyard-delivers-final-two-type-054-a-p-frigates-to-pakistannavy/.

Busbarat, Paul. “How Has China’s Belt and Road Initiative Impacted Southeast Asian Countries?” carnegieendowment.org, December 5, 2023. https://carnegieendowment.org/posts/2023/12/how-has-chinas-belt-and-roadinitiative-impacted-southeast-asian-countries?lang=en.